By Adena J. White

If there is one thing Kevin Ryan wants people to take away from the conversation around medical debt, it is that there are no villains.

“People seek out medical care because they need it. Providers are willing to provide medical care to save lives. Businesses have to generate an excess of revenue over expenses so they can stay open,” he said.

Ryan is currently associate dean for student and alumni affairs and an associate professor at the Fay W. Boozman College of Public Health at the University of Arkansas for Medical Sciences. Ryan obtained his Juris Doctor degree from the University of Arkansas at Little Rock William H. Bowen School of Law and works at the intersection of law and public health.

Throughout his career, Ryan has examined a series of issues that affect ALICE families, (meaning Asset-Limited, Income-Constrained, Employed) and the traditionally underserved. He considers it a privilege to be able to do so.

“This is far and away the absolute best job I’ve ever had in my life. I get to look at and learn about important issues that impact all of us and get to work with incredible teams of people trying to make things better.”

Ryan said the connection between personal bankruptcy filing and debt accrued through receipt of medical care is significant.

“People who file for bankruptcy, or debt reorganization, are required to roster out their debt,” Ryan explained. “When researchers have looked at and categorized these rosters, they found that debt related to medical care was the number one category year after year.”

Ryan said it is not always apparent in the research that medical debt is the leading driver of personal bankruptcy. This is because expenses related to medical care are often categorized as credit card debt. Upon further investigation, however, researchers determined that many people had used their personal credit cards to pay for medical expenses.

“Medical debt impacts so many people, so many families, and it is definitely disproportionately represented in lower-income folks,” Ryan said. “And, more importantly, it affects people who are working, and who — in many cases — are working multiple jobs to make ends meet.”

Ryan has been part of several teams that have studied ways to expand health insurance coverage. The studies have found that, just like the majority of people with medical debt, most of the people who were uninsured tended to work several jobs.

“These are not people just sitting at home. These are people who are working hard with several different jobs,” Ryan said. “And all of a sudden, an adverse life event occurs – there’s an accident, there’s an unexpected injury of some type, or they develop a disease. These are not events someone can plan for.”

The patient then seeks care for the health issue and is faced with the full cost of the bill if they are uninsured. Ryan said even those who are covered by health insurance may be responsible for a costly bill. According to the Kaiser Family Foundation, two-thirds of medical debts are the result of a one-time or short-term medical expense arising from an acute medical need.

To demonstrate how easily medical debts can accrue, Ryan painted a scenario using heart disease as an example, which is the leading cause of death in the United States. Heart disease, which includes coronary artery disease and heart attacks, costs the U.S. about $363 billion each year, according to the Centers for Disease Control and Prevention.

“Imagine you begin experiencing chest pains and are taken to the emergency room by ambulance. The doctor and nurses place an electrocardiogram and administer life-saving clot-buster medication. They conduct an angiogram during your five-day hospital stay, and you are discharged.

“Hypothetically speaking, let’s say the bill was $100,000. Your good insurance pays 80% of it, but you still have a debt of $20,000. The vast majority of people don’t have $20,000. That can be devastating to a fully insured family with two working adults.”

Lower-income, single-parent households are affected disproportionately. Ryan said if they work multiple jobs or work a shift outside of normal business hours, they may not have the ability to take themselves or their children to a doctor, which could increase the likelihood of costly trips to the emergency room for routine care. Additionally, the federal Emergency Medical Treatment & Labor Act ensures public access to emergency services regardless of ability to pay, making the emergency room the only option for those without health insurance.

Ryan said even if you do not subscribe to the idea that we are “our brother’s and sister’s keeper,” everyone should care about medical debt. It affects the cost of the entire health care system, and everyone ends up paying more.

“We pay more because the system isn’t rational. The system isn’t as balanced as it should be,” Ryan said. “We should care not only because it’s the right thing to do but because it affects all of our bottom lines.”

On March 18, 2022, the three nationwide credit reporting agencies — Equifax, Experian and TransUnion — announced that effective July 1, 2022, paid medical collection debt will no longer be included on consumer credit reports. In addition, the time period before unpaid medical collection debt would appear on a consumer’s report will be increased from 6 months to one year. In the first half of 2023, Equifax, Experian and TransUnion will also no longer include medical collection debt under at least $500 on credit reports.

Ryan said that while the credit reporting agencies’ recent decision to change medical collection debt reporting is an important step in ensuring medical debt does not negatively impact one’s credit score, there are some limitations.

“I am appreciative of what Equifax, Experian and TransUnion are doing. I think it’s a step in the right direction,” Ryan said. “However, the debt has to be paid before it will be removed from credit reports. While some families are able to eventually do that, it will take years for many ALICE families to pay off large amounts of medical debt.”

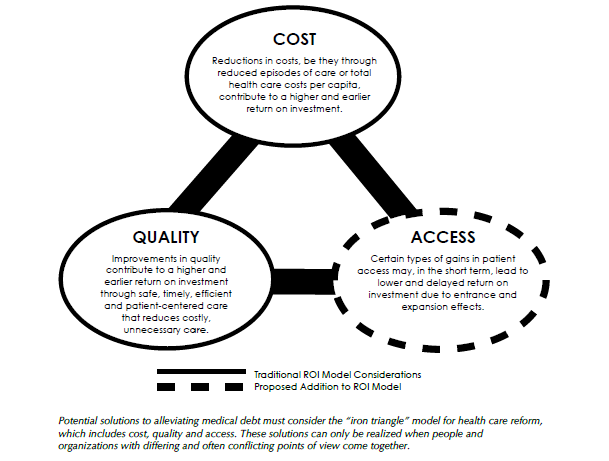

“People deserve a healthcare system that they can access when it’s needed to receive the proper quality of care in an affordable way. As a society, we’re all made better by having that system in place.

“I remain convinced that there’s some bipartisan way to fix it. I just know that somehow as a society if we grapple with it long enough, and get the right people involved in the discussion, we’ll be able to figure it out.”