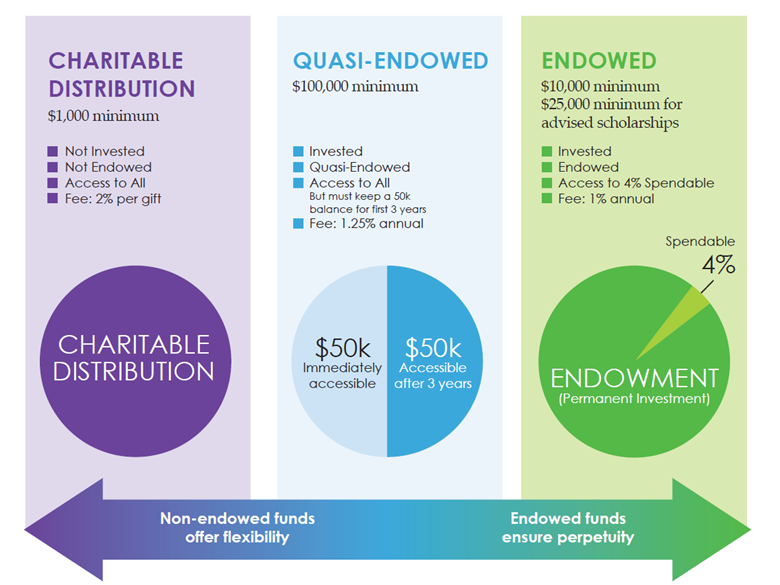

We offer three kinds of charitable funds to best meet the needs of donors with different time horizons.

PERMANENTLY ENDOWED FUNDS PROVIDE LONG-TERM SUPPORT

For those who take a long-term approach to philanthropy, an endowment offers longevity and stability. Endowments are permanently invested with only a portion of the fund used annually for grantmaking. The remaining funds are reinvested for the future, so long after you’re gone, the endowment will continue to support the causes you care about.

Download this one-pager to learn more about how an endowment works.

Permanent Endowment Minimum – $10,000

Fee – 1% Annual

QUASI-ENDOWED FUNDS PROVIDE DEEP IMPACT AND CONTINUED GROWTH

The quasi-endowed fund was designed for people who want to enjoy the excitement of giving larger grants now, along with the benefit of investing for future growth. These funds are invested in the markets to keep them growing, but there’s no limit on the amount that can be granted from your fund to the organizations you choose, as long as the balance remains above $50,000 for the first three years.

Download this one-pager to learn more about about how a quasi-endowment works.

Quasi-Endowed Fund Minimum – $100,000

Fee – 1.25% Annual

CHARITABLE DISTRIBUTION FUNDS PROVIDE IMMEDIATE IMPACT

A charitable distribution fund is ideal for people who want to support a short-term project, or take action quickly on an identified need. Charitable distribution funds are not invested in the markets, so the entire balance is available to grant to the charity of your choice at any time. Charitable distributions funds are NOT invested.

Charitable Distribution Fund – $1,000 minimumFee – 2% per gift (deposit)